| Platinum Price Performance USD | ||

| Duration | Amount | Change Amount |

|---|---|---|

| Today | 1375.7 | -1445.8 |

| 30 Days | 2473.900000 | -1098.2 |

| 6 Months | 1413.600000 | -37.9 |

| 1 Year | 953.7 | 422 |

| 5 Years | 1085.8 | 289.9 |

Monitor Real-Time Platinum Price Trends and Performance Over Time

You can check the updated platinum price performance over different time spans directly on our website. We provide detailed insights into the change in platinum prices, including the amount in USD and the percentage change for various time periods: today, the past 30 days, 6 months, 1 year, and 5 years. By tracking these trends, you can gain a clearer understanding of price movement patterns and make more informed investment decisions. Our real-time data ensures you’re always up-to-date with the latest market shifts.

| Price Of Platinum | ||

| Weight | Price | Change |

|---|---|---|

| Per Gram | 44.23 | -46.49 |

| Per Ounce | 1,375.70 | -1,445.80 |

| Per Kilo | 44,228.76 | -46,482.47 |

Gold Price USA Providing Accurate and Reliable Platinum Price Information for Investors

Gold Price USA is committed to providing investors with the tools they need to make informed decisions in precious metal investment. Our platform offers reliable tracking of the Platinum Price Per Ounce, Platinum Price Per Gram, and Platinum Price Per Kilogram, ensuring you always have access to the most accurate and up-to-date data.

We understand the importance of accuracy, which is why our prices are regularly updated to reflect real-time market conditions. Along with live price updates, we offer a variety of charts, including historical data, to help you analyze trends and make better investment decisions. At Gold Price USA, we strive to equip you with transparent, reliable information for confident investing in precious metals.

Track Live Platinum Prices with Gold Price USA for the Best Investment Insights

Gold Price USA offers platinum investors a reliable platform to track live platinum prices with its real-time platinum spot price chart, ensuring they stay informed of market movements. Our service provides live platinum price updates every few seconds, giving you the most accurate and timely data in the professional platinum bullion market. We offer various platinum weights, including ounces, grams, and kilos, to cater to every investor’s needs. With up to 5 years of historical data available, you can track the platinum pricing trend over time and make informed decisions based on a wider perspective. Whether you are looking to buy platinum or simply monitor the platinum price in USD, our real-time updates will keep you ahead of market fluctuations.

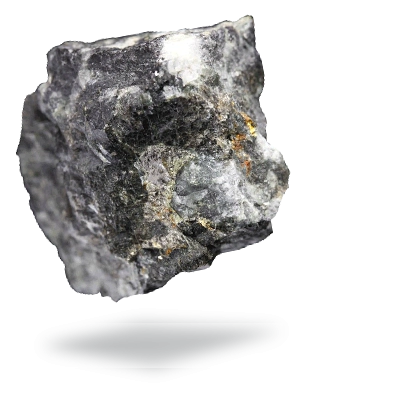

What is Platinum Bullion and Why is it a Profitable Investment?

Platinum (symbol Pt) is a rare and valuable metal, highly sought after for its industrial applications, especially in the automobile and medical industries. Known for its resistance to corrosion, platinum has been used for various purposes since ancient times. Geopolitical issues, supply and demand fluctuations, and inflation significantly impact platinum prices, making it an attractive investment option for those seeking long-term value. With over 80% of platinum production coming from South Africa, disruptions in this region can lead to price volatility, making it a dynamic market for investors.

Why Checking Platinum Prices is Crucial Before Making an Investment

Before purchasing platinum as an investment, it’s essential to conduct a thorough price check to ensure you’re making a well-informed decision. By examining a platinum price chart and staying updated on the spot price of platinum, investors can gauge the current price of platinum and its fluctuations. Monitoring the platinum price in USD, as well as the market price of platinum in different regions, including America, helps in assessing fair pricing. Comparing the price of platinum across multiple platforms and sources allows buyers to avoid overpaying and potentially secure a better investment. Understanding the current price of platinum relative to historical trends can also help investors time their purchase effectively, ensuring they buy platinum at a favourable rate.

Market Volatility

The prices of precious metals, including platinum, silver and gold, are known for their volatility, which can be influenced by various factors such as economic crises, changes in interest rates, inflation, or currency fluctuations. For instance, during times of financial instability, the price of platinum per ounce today may rise sharply as investors seek safe-haven assets, similar to the way gold and silver prices behave. Conversely, during periods of economic growth, platinum, silver and gold may see price declines. By regularly checking platinum price charts or gold spot price charts, investors can gain insights into market trends and make informed decisions based on historical price movements. Monitoring the current platinum price in USD, along with other precious metal prices, allows for strategic, timely investments.

Maximising Investment Potential

One of the main reasons to check platinum price is to maximize your return on investment. By understanding the platinum price in USD at any given time, investors can enter or exit the market at the optimal moment. For example, if platinum prices are lower compared to historical trends, it may be a good time to buy platinum coins or platinum bars. Conversely, if prices are higher than usual, it may be a better time to sell. Examining platinum price history provides valuable insights for long-term investment decisions and helps investors capitalise on price fluctuations.

Avoiding Overpayment

Precious metal dealers typically sell platinum and gold bullion, coins, and bars at prices above the spot price due to premiums. The cost of platinum today, for example, might be higher than the current platinum spot price due to these premiums, which can vary based on factors like rarity, demand, and production costs. By checking the spot price of platinum before buying platinum coins or platinum bars, investors can ensure they are not overpaying for their investment. This is particularly important for those purchasing rare platinum coins or gold collectible coins, where premiums can be substantial. Always ensure the price you pay reflects fair market value by cross-referencing the spot price.

Understanding Different Forms of Precious Metals

Precious metals like platinum, silver and gold come in various forms, including coins, bars, and bullion. The price of these metals will vary depending on their form. For instance, platinum bullion and gold bars are typically sold based on the spot price with slight premiums added for manufacturing and distribution. Platinum coins, such as the Platinum American Eagle, and gold coins like the Gold American Eagle, are often sold with added premiums due to their collectibility and limited availability. By checking the platinum spot price and the current gold price per ounce today, investors can accurately compare these different forms of precious metals and ensure they are making sound investment decisions.

Market Sentiment and Economic Indicators

The price of platinum, silver and gold is often influenced by global economic conditions, including inflation rates, interest rates, geopolitical tensions, and currency fluctuations. Monitoring these economic indicators helps investors gauge market sentiment and adjust their investment strategies accordingly. For instance, during times of economic instability, gold and platinum prices typically rise as investors seek stability. Keeping an eye on live platinum prices and gold exchange rates helps investors make informed decisions based on the current economic environment and market sentiment.

Avoiding Losses in a Bear Market

While platinum, silver and gold are often considered safe-haven investments, their prices can still experience significant downturns during bear markets. Monitoring platinum price charts and gold price history is essential to understanding market cycles and avoiding losses during periods of declining prices. For instance, if platinum prices per ounce are consistently dropping, it may indicate a bearish trend, prompting investors to wait before making a purchase. By analyzing real-time price updates and historical trends, investors can time their investments more effectively and avoid entering the market at a low point.

Hedging Against Inflation

Investors often turn to platinum, silver and gold as a hedge against inflation. As fiat currencies lose value due to inflationary pressures, the prices of precious metals generally rise. By checking the platinum price today or the current price of gold per ounce, investors can assess how the market is responding to inflation trends. During inflationary periods, gold and platinum typically increase in value, making them an attractive alternative to cash or other investments. Monitoring the current platinum price allows investors to capitalize on the upward movement of precious metals as inflationary pressures grow.

The History and Investment Potential of Platinum Metal

Platinum, a precious metal with the symbol Pt on the periodic table, has a fascinating history that dates back to ancient civilizations. While platinum itself was not officially discovered until the 18th century, its use can be traced back even further. Ancient Egyptian and pre-Columbian South American civilizations utilized platinum in alloys, especially in jewelry and decorative items. The metal was considered valuable for its durability, but it was not fully understood or appreciated by early cultures.

Platinum was officially recognized as a distinct metal in 1735 by the Spanish chemist Antonio de Ulloa. He found the metal while exploring the mines in South America and described it as an “unmeltable” material. The name “platinum” itself is derived from the Spanish word “platina,” meaning “little silver.” Over time, platinum’s unique properties, such as its resistance to corrosion, high melting point, and rarity, made it highly desirable for various applications.

In the 19th and 20th centuries, platinum gained significant importance in industrial applications, particularly in the automotive and chemical industries. The metal’s ability to act as a catalyst in chemical reactions made it invaluable for processes such as oil refining and manufacturing fertilizers. Its use in the automotive industry, where it is used in catalytic converters to reduce harmful emissions, further enhanced its demand.

Today, platinum’s industrial value remains a significant factor in its price and demand. However, it is also highly prized in jewelry, with its white, lustrous appearance and hypoallergenic properties. Platinum is often chosen for high-end, luxury jewelry, particularly for engagement rings and wedding bands.

From an investment standpoint, platinum has always been considered a valuable asset. While it is often compared to gold and silver, platinum’s rarity (with annual production much lower than gold or silver) adds a layer of exclusivity and potential for significant returns. Historically, platinum prices have been more volatile than gold, driven by its industrial demand and geopolitical factors affecting production, particularly in South Africa, which accounts for over 80% of the world’s platinum supply.

Investors in platinum are drawn by its dual appeal: its historical status as a precious metal and its ongoing role in industrial applications. As the demand for cleaner technologies and automotive innovation continues to grow, platinum’s value may increase. Additionally, geopolitical issues, supply disruptions, and fluctuations in the global economy further contribute to platinum’s potential as an investment.

Today, platinum is traded on major commodity markets, and investors can buy platinum bullion, coins, and exchange-traded funds (ETFs). Many view platinum as a hedge against inflation and a way to diversify an investment portfolio. Whether through direct purchases of platinum or through investment products tied to platinum’s value, the metal continues to hold strong investment potential, particularly for those looking to capitalize on its unique properties and market dynamics.

What is the current price of platinum?

The price of platinum fluctuates regularly due to market conditions, economic factors, and industrial demand. To stay updated on the latest platinum price, check the live platinum spot prices on Gold Price USA.

Why is platinum so valuable for investment?

Platinum is a rare and precious metal that holds value due to its scarcity, industrial uses (particularly in automotive and medical applications), and its role as a store of value. Its price is often influenced by global economic conditions, including inflation and demand in key industries. For the most up-to-date platinum prices, refer to Gold Price USA.

How can I buy platinum coins or bars as an investment?

Investors can purchase platinum coins and bars through trusted dealers or online platforms. Platinum bullion, including coins like the Platinum American Eagle, is typically sold based on the spot price of platinum with added premiums. To make sure you’re buying at the best price, check the platinum price today on Gold Price USA.

How do platinum prices compare to gold prices for investment?

Platinum, silver and gold are both considered valuable precious metals, but platinum is rarer than gold, making it more volatile in price. Platinum prices can fluctuate based on industrial demand and economic conditions, while gold is often seen as a safe-haven asset during times of economic uncertainty. For real-time updates and detailed charts, check Gold Price USA.

What factors affect the price of platinum?

The price of platinum is influenced by several factors, including industrial demand (especially from the automotive and medical sectors), geopolitical tensions, supply disruptions (particularly from South Africa, which produces over 80% of the world’s platinum), and broader economic conditions like inflation. Stay informed by checking the live platinum price on Gold Price USA.

How can I track the historical trends of platinum prices?

To make informed investment decisions, it’s important to monitor platinum’s historical price movements. Gold Price USA offers up to five years of historical data, allowing you to analyze long-term trends and maximize your investment potential.

What’s the best way to buy platinum as an investment?

The best way to buy platinum is through physical platinum bars or coins from reputable dealers at competitive prices. You can also consider investing in platinum exchange-traded funds (ETFs) or platinum mining stocks. For the most accurate pricing, including the price of platinum in USD, check Gold Price USA for real-time updates.

Should I buy platinum during a market dip?

Buying platinum during a market dip can be an effective strategy, as it allows you to acquire the metal at lower prices. However, it’s essential to monitor market trends and check the current platinum price regularly. For live updates on platinum pricing, visit Gold Price USA.

What is the premium on platinum coins and bars?

The premium on platinum coins and bars refers to the additional cost over the spot price, which accounts for minting, distribution, and market demand. Platinum coins, especially those from recognized mints like the U.S. Mint, Royal Canadian Mint, Royal Mint UK may carry higher premiums.

How do geopolitical events affect platinum prices?

Geopolitical events, such as political instability or trade tensions, can significantly impact platinum prices. Disruptions in production or global trade conflicts can cause price volatility. To monitor the effects of geopolitical events on platinum prices, stay updated with live pricing on Gold Price USA.

How does supply and demand impact the price of platinum?

Supply and demand are key drivers of platinum prices. A limited supply, particularly from South Africa, combined with rising industrial demand, can lead to higher prices. Conversely, oversupply or reduced demand may cause prices to drop. For real-time pricing and market conditions, check the platinum price today on Gold Price USA.

Can I invest in platinum through ETFs or other financial products?

Yes, you can invest in platinum through exchange-traded funds (ETFs), platinum mining stocks, or platinum-focused mutual funds. These financial products provide exposure to platinum prices without the need to purchase physical platinum. Check the platinum spot prices and trends or the latest updates on Gold Price USA.

What are the tax implications of investing in platinum?

The tax implications of investing in platinum can vary depending on the country of residence and the form of platinum held (such as physical bullion versus ETFs). In many countries, profits from the sale of platinum are subject to capital gains taxes. For more details on tax regulations and platinum pricing, visit Gold Price USA for updated market information.

How volatile is platinum compared to other precious metals?

Platinum tends to be more volatile than gold and silver due to its industrial demand and reliance on specific sectors like the automotive industry. Fluctuations in these sectors can cause platinum prices to rise or fall sharply. For tracking platinum’s volatility and its price movements, check the platinum price trends on Gold Price USA.

What are the risks associated with platinum investments?

Platinum investments carry risks similar to other precious metals, such as price volatility, market fluctuations, and supply chain disruptions. Additionally, platinum’s industrial use makes it more sensitive to changes in demand. To stay informed about potential risks and market conditions, refer to the live platinum prices and trends on Gold Price USA